‘We are only in the middle of the bull market’ and a buying opportunity could come soon, JPMorgan says

We are only in the middle of current bull market, JPMorgan strategists said.

Tauseef Mustafa/Agence France-Presse/Getty Images

After sweeping to new records on Friday, U.S. stocks were set to fall at the start of the week.

The records came despite weak November jobs data, as investors were buoyed by hopes of another COVID-19 financial-aid package from Congress. However, the Dow Jones Industrial Average

DJIA,

was set to slip at the open, with Dow futures

YM00,

implying a 100-point loss.

In our call of the day, JPMorgan

JPM,

strategists said any near-term equity correction would be a buying opportunity, as “we are only in the middle of the current bull market.”

The investment bank’s global markets strategy team said there was a clear consensus when it came to year-ahead trading themes, but urged investors to seek out less-crowded trades. They said the ‘long equities’ theme was crowded tactically and prone to a correction in January.

Elevated positioning by momentum traders and rebalancing flows by balanced mutual funds and pension funds posed some downside risk into year-end, they added in a note to clients. However, over the medium term, the long equity trade appears less crowded and closer to average than overbought levels.

“Thus any equity correction in the near term would represent a buying opportunity as in our opinion we are only in the middle of the current bull market.”

With the consensus view rarely playing out in its entirety, JPMorgan urged traders to scale exposures to avoid an “overly concentrated portfolio.” One way of doing this was by limiting exposure to the most crowded trades, which currently include short the U.S. dollar vs. cyclical developed market currencies and bullish positions on copper and bitcoin, as well as overweight non-U.S. equities vs U.S. stocks.

But the strategists said, “luckily” there were several less-crowded consensus trading themes, including overweight emerging market equities against developed market equities, and long gold and oil. Favoring value stocks over growth ones at an individual stock level was also a less-crowded consensus trade.

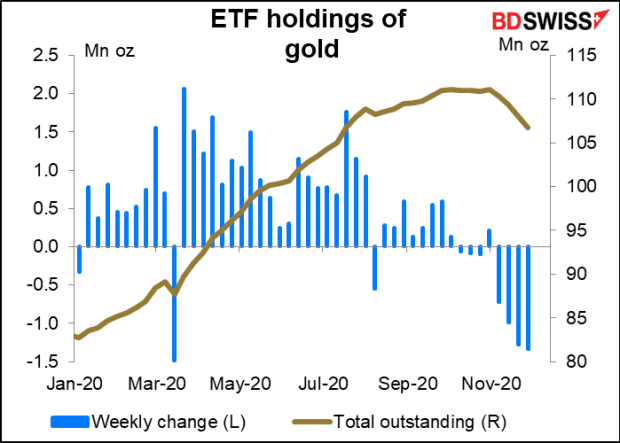

The chart

BDSwiss Market Insights

This chart from BDSwiss shows that the week to Dec.1 was the fourth- straight week of a reduction in ETF (exchange-traded fund) holdings of gold

GC00,

Its head of investment research, Marshall Gittler, noted that this was “not by any way the longest or deepest selloff of gold ETFs,” with 26 consecutive weeks of falling holdings in 2013. In contrast, ETF holdings of silver increased after two weeks of decline.

The markets

U.S. stock futures slipped lower early on Monday, with Dow futures

YM00,

0.3% down implying a 100-point loss for the Dow Jones Industrial Average

DJIA,

at the open. S&P 500

ES00,

and Nasdaq

NQ00,

futures also dipped. European stocks

SXXP,

also fell as U.K. and European Union negotiators failed to reach a post-Brexit trade deal over the weekend. Sterling

GBPUSD,

tumbled 1.3%, as the prospect of a no-deal scenario became more likely.

The buzz

The U.S. is preparing new sanctions on at least a dozen Chinese officials in response to Beijing’s crackdown on dissent in Hong Kong, Reuters reported.

President Donald Trump said on Sunday his personal attorney Rudy Giuliani has tested positive for COVID-19. Giuliani has been traveling the country in an effort to fight Trump’s election loss.

Networking hardware company Cisco Systems

CSCO,

said it is buying software company IMImobile

IMO,

for £543 million ($720 million), or 595 pence in cash per share, a 48% premium to Friday’s close. IMImobile stock soared 47% early on Monday.

Airbnb plans to boost the proposed price range of its initial public offering to between $56 and $60 a share, from $44 to $50, The Wall Street Journal reported on Sunday. The new range would value the company at up to $42 billion on a fully diluted basis.

Chinese exports jumped 21.1% in November, accelerating from 11.4% in October.

Random read

Monolith discovered on Isle of Wight, similar to those found in the U.S. and Romania.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.